How to Fix Your Credit Report by Removing Negative Items

Fixing your credit report by removing negative items might seem difficult, but it doesn’t have to be. A clean credit report is important because it affects your ability to get loans, credit cards, or even housing. Negative items, like late payments or errors, can lower your credit score over time. By understanding the steps to identify and dispute these negative marks, you can improve your credit profile and take control of your financial future. It’s easier than you think!

What is a credit report?

A credit report is a detailed record of your borrowing history from different financial institutions, such as banks, credit card companies, and lenders. It includes information about your payment history, outstanding debts, and personal information. Credit reporting agencies gather this data and use it to create a credit score, which is a numerical representation of your creditworthiness. This score can range from 300 to 850, with higher scores indicating better credit health.

Why are negative items on my credit report?

Negative items on your credit report can come in many forms. They can be the result of late or missed payments, collections accounts, charge-offs, bankruptcies, foreclosures, or even errors made by the credit reporting agencies. These negative marks can stay on your credit report for up to seven years, and bankruptcies can remain for ten years. They can significantly impact your credit score and make it difficult to receive credit or get favorable interest rates.

Identifying Negative Items

The first step to fixing your credit report is identifying the negative items. You can obtain a free copy of your credit report from each of the three major credit reporting agencies – Equifax, Experian, and TransUnion – once every 12 months. Review your reports carefully, noting any discrepancies or incorrect information.

Common Types of Negative Items on Credit Reports

- Late Payments: If you miss a payment by more than 30 days, it will be reported as late to the credit bureaus.

- Collections Accounts: When an account becomes severely past due, it may be sent to a collection agency. This results in a new negative mark on your report.

- Charge-offs: If an account is not paid for a long period, the creditor may write it off as a loss and report it as a charge-off.

- Bankruptcies: This occurs when an individual or business declares that they are unable to pay their debts. It can remain on your credit report for up to 10 years.

- Foreclosures: If you fail to make mortgage payments, the lender may take possession of the property. Foreclosures can also stay on your credit report for up to seven years.

Disputing Negative Items

If you find any incorrect information or errors on your credit report, you have the right to dispute them with the credit reporting agency. The process for disputing negative items involves the following steps:

- Identify the item: Gather all necessary documentation to prove that the item is incorrect or does not belong to you.

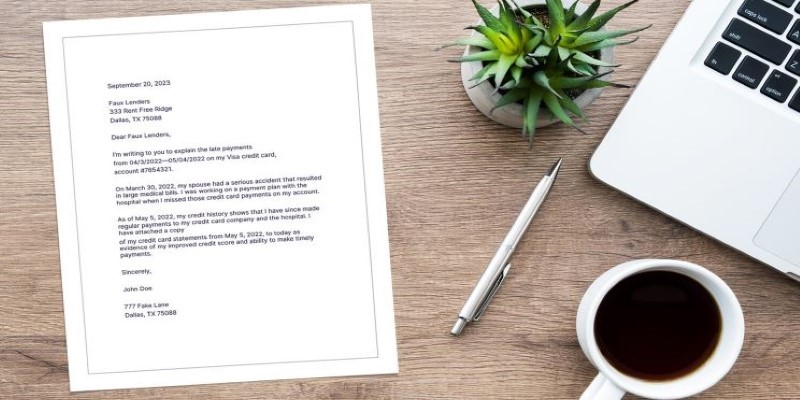

- Write a letter: Compose a formal letter to the credit reporting agency detailing the reasons for your dispute. Be sure to include any relevant evidence or supporting documentation to strengthen your case.

- Send it off: Send your dispute letter and accompanying documents via certified mail with a return receipt requested.

- Wait for a response: The credit reporting agency must investigate your claim within 30 days and provide an update on their findings.

- Review the results: If your dispute is successful, the negative item will be removed from your credit report. If not, you can request to add a statement explaining your side of the story.

Negotiating with Creditors

If the negative item on your credit report is valid, consider negotiating with the creditor to have it removed. You could propose paying off the debt in exchange for its removal or request a "pay-for-delete" agreement, where the creditor agrees to eliminate the negative entry once the full amount is paid.

Building Better Credit Habits

While removing negative items from your credit report can improve your score, it’s essential to focus on building better credit habits for long-term financial health. Here are some tips to help you maintain a good credit profile:

- Pay bills on time: Simplify your finances by setting up automated payments or reminders, ensuring you never miss a due date.

- Keep credit card balances low: Aim to keep your credit card balances below 30% of your available credit limit.

- Check your credit report regularly: Keep an eye out for any new negative items and dispute them promptly if found incorrect.

- Limit new credit applications: Each time you apply for new credit, it results in a hard inquiry on your report, which can temporarily lower your score.

- Use credit responsibly: Only borrow what you can afford to pay back and avoid taking on more debt than necessary.

By following these tips, you can maintain a positive credit profile and prevent the need for future credit repair. Remember, fixing your credit report takes time and effort, but it is worth it in the long run.

Monitoring Your Progress

Disputing negative items on your credit report is just the first step—tracking your progress is just as important. You’re entitled to one free credit report per year from each of the three major credit bureaus, giving you the chance to review changes and improvements to your credit score. If you want more frequent updates, consider using a credit monitoring service. These services provide regular insights into your credit profile, often for a small fee, helping you stay informed and in control.

Conclusion

Your credit report is an essential tool in managing your financial health. By understanding how it works and taking steps to identify and dispute negative items, you can improve your credit score and take control of your financial future. Remember to practice responsible borrowing habits to maintain a positive credit profile and regularly monitor your progress to ensure continued success. So, regular check-ups and actively working towards a positive credit profile can go a long way in ensuring better financial stability for your future.